News

timeline • 2020-11-24

Timeline

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras mattis iaculis ultricies. Suspendisse ultricies magna at risus venenatis, sit amet ullamcorper urna tincidunt. Aenean imperdiet molestie nibh aliquet imperdiet. Pellentesque ultrices est eu tellus laoreet, eget scelerisque ante fermentum. Phasellus sodales purus sit amet lacinia iaculis. Integer dictum nisl sit amet mattis laoreet. Donec mollis, erat eu mollis pharetra, ligula metus suscipit urna, et tristique nunc nunc eget ante. Duis id vehicula massa. Cras mattis sapien lacus, in sodales quam tempor vel. Aenean maximus nibh turpis, a aliquet tellus interdum porta. Nullam maximus lectus ac diam rhoncus auctor. Morbi venenatis vehicula viverra. Ut mattis et massa vel iaculis.

Read Moreblog • 2020-11-06

More moves lower

It has been quite a week, with significant event risk. We have heard from the FOMC, Bank of England and Reserve Bank of Australia.

Read Moreblog • 2020-10-22

Less Negative the New Positive?

We already seem to find ourselves following results from the third quarter. Of particular interest is always how the financial sector is performing.

Read Moreblog • 2020-10-16

Adjusting to new dynamics in counterparty credit risk

At the recent Association of Corporate Treasurers Annual Conference, our CEO, Kevin Cook and Chief Product Officer, Henry Adams hosted a fascinating discussion with Katherine Horrell (Group Treasurer, the AA) and Marion Barre (Senior Treasury Officer, UN Migration Agency) around how counterparty credit risk affects corporate treasury and how that might change in a post-COVID world.

Read Moreblog • 2020-10-01

Records broken, broken records

With so much going on at home and across developed economies it is challenging to keep up with other important events unfolding that are both meaningful and worth keeping abreast of.

Read Moreblog • 2020-09-09

COVID, Credit and Corporate Treasury

I recently moderated the latest instalment in our TreasurySpring webinar series on Managing Cash in a Crisis –

Read Moreblog • 2020-08-12

Divergence

Risk-on sentiment continues to be the theme in markets, with stocks flashing “green” across the board for most of yesterday.

Read Moreblog • 2020-07-17

The disconnect continues

A sense of optimism with potential vaccines and easing of lockdowns in most jurisdictions is helping keep the buy button in stocks busy.

Read Moreblog • 2020-06-25

How steep is your swoosh?

Never a dull market, despite these geographically constrained times.

Read Moreblog • 2020-06-12

A dose of reality

There has been much by way of talk from the top over the last 48 hours where we have seen releases from the OECD as well as FOMC on the current state of affairs.

Read Moreblog • 2020-05-07

Managing cash in a crisis - lessons from 2008

In 2008, my partners and I were managing fixed income portfolios in a hedge fund. It was a fascinating time to have a front row seat to financial markets and, to a large extent, that period shaped the way that we have thought about the world and built our businesses ever since.

Read Moreblog • 2020-04-23

23th April Market Commentary - "The eye of the storm"

It feels to us that we might currently be in the “eye of the storm”.

Read Moreblog • 2020-03-27

Liquidity... what liquidity

The recent turmoil has reverberated across many pockets of financial markets and we have already witnessed and engaged in a great deal of discussion around the scale of discounts being offered across the mutual fund space.

Read Moreblog • 2020-03-18

18th March Market Commentary - unprecedented times

This is a tough time for the world. Like most of you, our entire team moved to working from home as of yesterday, without any idea of when we will return to the office.

Read Moreblog • 2020-03-11

A Safe Haven through the Storm

We are living in unprecedented times. The last weeks have seen the most significant moves in financial markets in more than a decade, driven by fears as to the potential effects of the coronavirus outbreak. Are you looking for a safe place to store cash holdings through this extraordinary and unpredictable period? If so, you are in the right place...

Read Morecommentary • 2020-03-09

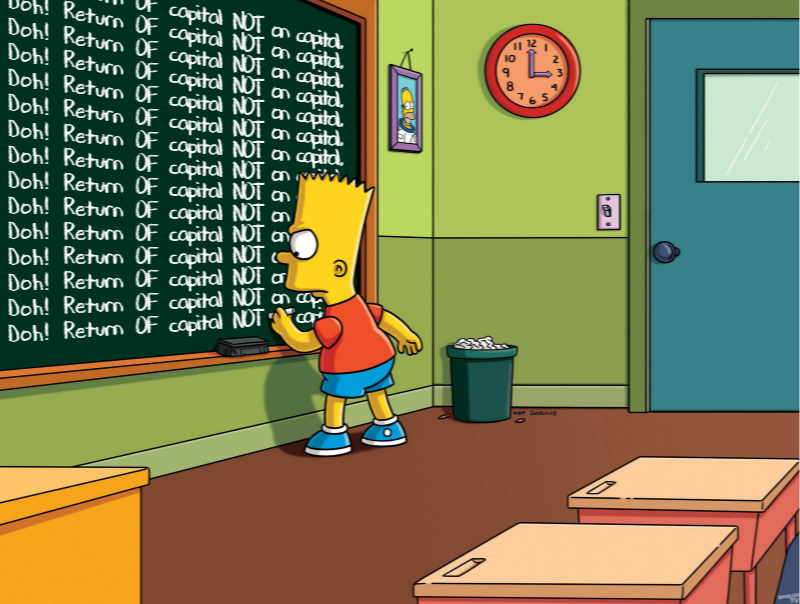

A Safe Haven through the Storm

Monday Meltdown. This week we are looking to keep our message brief. The primary concern in the market is no longer return on capital, rather the return OF capital. TreasurySpring FTFs offer direct access to the lowest-risk store of value in the market through its sovereign and bank secured FTFs.

Read Morecommentary • 2020-03-05

5th March Market Commentary

"Extraordinary measures" this week including the release of prisoners...

Read Morecommentary • 2020-02-25

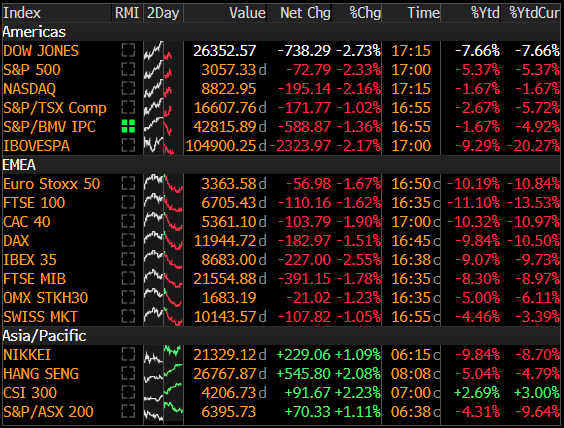

25th February Market Commentary

The week has started in risk off mode. Equity markets across the world have sold off heavily on the greater geographical dispersion and scale of those infected by Covid-19.

Read Morecommentary • 2020-02-11

11th February Market Commentary

Since our last commentary rather a lot has changed, our concerns from then have all but blown away (for now!). A lot can happen in just two weeks.

Read Morecommentary • 2020-01-24

24th January Market Commentary

2020 has kicked off with a record binge amount of debt issuance across governments, banks and corporates in Europe, whilst the rest of the world has also been sure not to miss the party.

press release • 2020-01-16

TreasurySpring makes senior Sales hire on the back of strong appetite for FTFs

TreasurySpring, the London-based financial technology company that enables firms to minimise risk and maximise returns on excess cash balances, today announced that John Bentley has joined as Head of Sales to lead the firm’s expansion strategy.

Read Morecommentary • 2020-01-08

8th January Market Commentary

Financial markets ended the year in relative calm, with the Fed carefully managing the volatility often associated with the season. The consequent stable prices and good liquidity allowed markets to hold on to the significant upside of the prior twelve months. This made for a far happier Christmas...

Read Moreblog • 2019-12-17

Merry Christmas! 2019 in Review

As the year draws to a close, it is naturally a period for reflection. 2019 has, for a plethora of reasons, been nothing short of stellar. Many global equity indices have broken through ceilings, posting record highs. Investors also appear to be more concerned than ever with ethical asset allocation, hardly a day has gone by this year that one does not hear or see the letters ESG...

Read Morecommentary • 2019-11-28

28th November Market Commentary

Happy Thursday, and for our American friends, Happy Thanksgiving!

Read Morepress • 2019-11-27

Treasury Today: A new alternative to bank deposits and MMFs

The short-term space for corporate treasurers is quite limited; the effort required to move beyond bank deposits and MMFs sees to that. But a new platform aims to bring a few more colours to the palette.

Read Moreblog • 2019-11-15

Bank Secured FTFs are now live!

The ability to place secured funds for a week to a year with a highly-rated global bank at rates that beat most unsecured deposit levels is something worth celebrating, or even better, investing in! For a brief commentary on why this is an important development, not just for our business but for wholesale funding markets in general, read Kevin's short blog post.

Read Moreblog • 2019-11-14

Repo Man

I remember the first time that I ever came across the term “repo” in the context of finance. It was 2006 and I was structuring a lending transaction for the hedge fund I was working for, when one of our lawyers suggested that we “do it as a repo”. I had no idea what he was talking about and my mind drifted to thoughts of property repossession and Emilio Estevez.

Read Morecommentary • 2019-10-29

29th October Market Commentary

Plenty to talk about since our last piece, although for the UK readership sadly still no sign of a solution one way or the other to the referendum held a staggering three years and four months ago - hot off the press is that Labour is now backing an early election which may finally at least start us on a (long and winding) path towards closure...

Read Moreblog • 2019-10-04

The ECB gives birth to a new benchmark...

Central banks and their respective regulators have been working hard to replace the Libor reference rates of old, following the discovery of widespread manipulation leading to fines running into many billions of dollars internationally.

Read Moreblog • 2019-09-20

"What are all these repo headlines about?"

Repo (short for a repurchase agreement) is the grease in the wheels of financial markets, where banks lend to one another, but on a secured basis. This week has seen us enter a period of severe dislocation in these markets.

Read Morepress release • 2019-09-16

TreasurySpring raises £2m to fuel growth

TreasurySpring, the London-based financial technology company today announced the closing of its latest capital raise, securing £2m of investment in a round that was led by ETFS Capital, with participation from MMC Ventures and existing investors.

Read Morepress release • 2019-07-10

TreasurySpring Public Launch

TreasurySpring launches Fixed-Term Fund (FTF) platform following a rigorous and successful Beta testing phase during which more than $400M of FTFs were issued.

Read Morecommentary • 2019-07-09

9th July Market Commentary

Since our last distribution Central Bank independence has been a hot topic (potato). In the US, the President has for some time now been pressing the Federal Reserve to change the tone, cut rates and by doing so further stimulate what has been one of the longest bull runs in history.

Read Moreawards • 2019-06-05

TreasurySpring voted top B2B fintech at Money20/20 Europe

We were delighted to be the only B2B fintech to make it into the final three of Money20/20 Europe's competition to find Europe’s most exciting financial technology startup.

Read More

commentary • 2020-05-27

27th May Market Commentary - At least the sun is shining!

There is plenty to be cheerful about since the lockdown began on 23 March (in the UK at least).

Read More